Ethereum Price Prediction: Analyzing ETH’s Path to $5,000 Amid Strong Fundamentals

#ETH

- Technical Strength: ETH trading above 20-day MA with positive MACD momentum indicates bullish technical positioning

- Institutional Adoption: $7.45B in tokenized Treasuries and growing institutional flows demonstrate expanding mainstream acceptance

- Network Fundamentals: Record on-chain activity and 300% transaction growth on Starknet highlight ecosystem robustness and utility demand

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Average

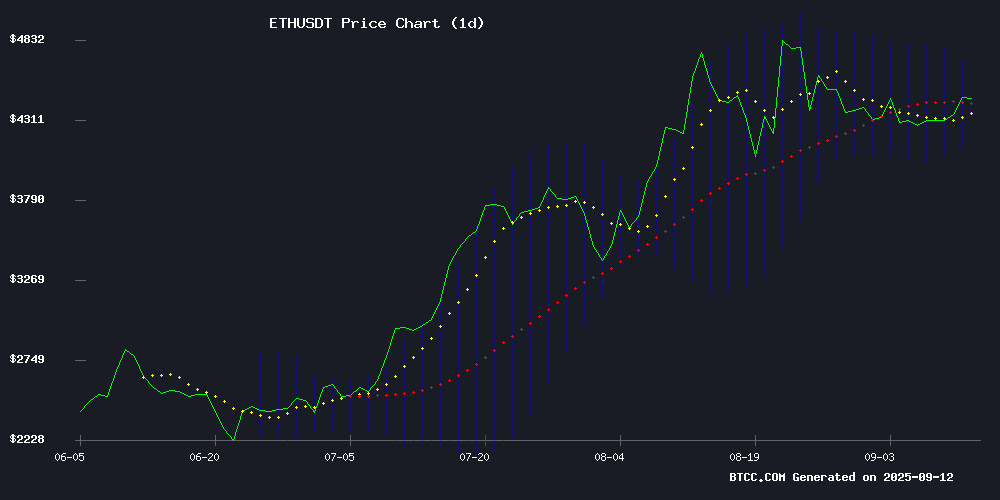

ETH is currently trading at $4,452.65, positioned above its 20-day moving average of $4,402.68, indicating sustained bullish momentum. The MACD reading of 25.69 suggests positive momentum continuation, while the Bollinger Bands show ETH trading comfortably within the upper range of $4,646.06 to lower band of $4,159.31. According to BTCC financial analyst Mia, 'The technical setup remains constructive with ETH holding above critical support levels, though traders should monitor the $4,646 resistance for potential breakout opportunities.'

Market Sentiment: Institutional Adoption and Network Activity Drive Optimism

Recent developments show strong institutional interest with tokenized U.S. Treasuries reaching $7.45 billion and ethereum being positioned as a long-term reserve asset by industry leaders. Network metrics are particularly encouraging - Starknet's 300% transaction surge and record on-chain activity demonstrate robust ecosystem growth. BTCC financial analyst Mia notes, 'The combination of institutional flows and fundamental network strength creates a compelling investment thesis, though profit-taking near resistance levels may cause short-term volatility.'

Factors Influencing ETH's Price

Tokenized U.S. Treasuries Surge to $7.45B Amid Institutional Adoption

Tokenized U.S. Treasuries have quietly become one of crypto's most consequential narratives, with holdings reaching a record $7.45 billion in late August. The milestone eclipsed July's previous peak of $7.42 billion, marking a threefold year-over-year expansion.

BlackRock's BUIDL fund and Fidelity's Ethereum-based offering are driving much of the growth, signaling major asset managers are constructing the infrastructure for large-scale on-chain fixed income. "We're witnessing the early stages of traditional capital absorption," observed one market commentator.

The appeal lies in solving legacy Treasury market inefficiencies—slow settlements, excessive intermediaries, and fragmented access. Tokenization promises instantaneous settlement, 24/7 markets, and fractional ownership of what remain fundamentally risk-free assets.

Yet questions persist about whether regulatory frameworks can keep pace with innovation. As Centrifuge's COO noted, the technology is advancing faster than policy—a recurring theme in crypto's collision with traditional finance.

SharpLink Co-CEO Positions Ethereum as Long-Term Reserve Asset

Joseph Chalom, Co-CEO of SharpLink, has articulated a strategic vision for ethereum that diverges from speculative trading. The publicly traded firm now holds over 837,230 ETH—valued at $3.7 billion—representing 0.69% of circulating supply. This positions SharpLink among the most aggressive corporate adopters of crypto treasury strategies.

The focus lies on Ethereum's utility for stablecoins, tokenization, and cost-efficient trading infrastructure. "When institutions realize they can reduce capital requirements and settlement risk, adoption becomes inevitable," Chalom told Decrypt. He describes this institutional education process as the "WHITE swan event" driving mainstream acceptance.

SharpLink's stance counters concerns about corporate ETH hoarding creating sell-side pressure. "We are accumulators, not sellers," Chalom emphasized, noting debt instruments and stock buybacks could provide liquidity alternatives. The company frames ETH as a permanent reserve asset—a paradigm shift from treating cryptocurrencies as trading vehicles.

Ethereum Sees Dual Momentum With Institutional Flows and Record On-Chain Activity

Ethereum is entering one of its most powerful phases yet, combining DEEP institutional interest with unprecedented levels of on-chain activity, according to CryptoQuant. Fund holdings have doubled since April 2025, now totaling 6.5 million ETH, while large whale wallets collectively hold over 20 million ETH. This surge underscores the asset's growing appeal to sophisticated investors.

The network's staking confidence has reached new highs, with the total amount of ETH staked climbing to an all-time peak. Simultaneously, smart contract usage and spot ETF developments highlight ETH's dual role as both a financial asset and the dominant programmable settlement layer.

Market dynamics suggest resistance levels may temper near-term gains, but the underlying fundamentals remain robust. Ethereum's trajectory reflects a maturing ecosystem where institutional adoption and on-chain utility converge.

Ethereum Price Rally and Emerging Altcoin Remittix Gain Traction

Ethereum's price trajectory is capturing market attention as ETH shows signs of recovery, briefly touching a record high NEAR $4,950. Analysts now project a potential surge to $8,000, fueled by institutional inflows, staking demand, and growing ETF interest. The $4,250 level remains a critical threshold to watch.

Meanwhile, Remittix—an altcoin designed for real-world payments—is gaining momentum as a bridge between traditional finance and DeFi. The project has secured early funding milestones, previewed a wallet beta for Q3, and landed listings on exchanges like BitMart. Its utility-driven approach contrasts with ETH's steady climb, offering a compelling alternative for investors seeking high-impact opportunities.

Ethereum Faces Resistance as Profit-Taking Threatens Rally

Ethereum's ascent toward new highs may stall as market indicators flash warning signs. The cryptocurrency's supply in profit approaches 95%, a threshold historically linked to local tops. When this level is breached, investors often rush to lock in gains, creating downward pressure.

The $4,500 price point has emerged as formidable resistance, with multiple rejection attempts over the past fortnight. Glassnode data reveals growing caution among long-term holders, as evidenced by rising Liveliness metrics. This on-chain behavior typically precedes periods of consolidation or correction.

Market dynamics now present a tug-of-war between bullish sentiment and profit-taking impulses. While macroeconomic conditions remain favorable for digital assets, Ethereum-specific selling pressure could override broader optimism. The altcoin king's next MOVE hinges on whether accumulation can overcome distribution at current levels.

Virtual Protocol Price Drop: Lookonchain Reveals Post-Surge Twist

Virtual Protocol's $VIRTUALS token faced a sudden price drop after an undisclosed entity offloaded a significant amount of Ethereum during its uptrend. The move caught traders off guard, sparking speculation about potential profit-taking or strategic repositioning.

Market observers note the sell-off occurred despite strong momentum, raising questions about the sustainability of recent gains. Ethereum's involvement adds complexity, as large movements of major cryptocurrencies often signal broader market shifts.

Institutional Demand for Ethereum Persists Amid Market Uncertainty

Ethereum's price action reflects a cooling trend as traders await clearer signals, with ETH consolidating near critical levels. The asset's earlier momentum has faded, mirroring Bitcoin's sideways movement while some altcoins post modest gains.

Despite the pause, institutional accumulation remains robust. Four new wallets moved 78,229 ETH off Kraken this week—a notable capital rotation suggesting long-term positioning. Ethereum's dominance in DeFi, NFTs, and layer-2 ecosystems continues to anchor institutional confidence.

Macroeconomic crosscurrents complicate the outlook. Weak US labor data and Fed policy uncertainty maintain volatility, though anticipated rate cuts could later buoy risk assets. The market now balances these opposing forces: structural demand for ETH's blockchain utility versus short-term macro headwinds.

Starknet Daily Transactions Surge 300% in the Past 30 Days Amid Network Activity Growth, Institutional Interest

Starknet (STRK), an Ethereum Layer-2 scaling network leveraging zero-knowledge proofs (ZKPs), has seen its daily transaction volume skyrocket by 300% over the past month. Data from Token Terminal and Nansen reveals a jump from 150,000 to nearly 900,000 transactions daily, signaling robust adoption.

The surge reflects heightened activity from both existing users and new wallet addresses. This growth underscores Starknet's rising appeal as a low-cost, high-throughput solution for decentralized applications—a clear alignment between its technological offerings and market demand.

Ethereum Staking Activity Surges as Investors Show Strong Confidence

Ethereum has regained bullish momentum, trading above $4,300 after days of bearish pressure. The rebound coincides with a sharp increase in staking activity, signaling heightened investor confidence in the network's long-term potential.

More than 36.1 million ETH—nearly 30% of circulating supply—is now locked in staking contracts. At current prices, the staked ETH represents a $158 billion commitment from institutional and retail participants. This trend underscores Ethereum's transition to proof-of-stake as a fundamental value proposition rather than just a yield opportunity.

The surge in staking activity persists despite ongoing market volatility, suggesting holders are prioritizing network participation over short-term trading gains. CryptoGucci, a prominent market observer, highlighted the milestone on social media platform X.

78,229 ETH Vanishes From Kraken: Are Whales Prepping for the Next Rally?

Institutional demand for Ethereum shows no signs of waning, with $342 million worth of ETH abruptly withdrawn from Kraken. Four newly created wallets moved 78,229 ETH off the exchange in a 10-hour window, signaling potential long-term accumulation. Such exchange outflows typically constrict supply, creating favorable conditions for price appreciation.

Ethereum's market structure appears poised for volatility. The asset trades above $4,430 as analysts watch for a decisive close above $4,500—a level that could catalyze fresh all-time highs. Bollinger Band compression suggests an impending significant price movement, reinforcing the bullish thesis building among institutional participants.

Ethereum Price Analysis: Can ETH Make Another Run at $5K?

Ether trades in a narrow range as market participants await a decisive catalyst. The cryptocurrency hovers above the $4.2K-$4.3K support zone, lacking momentum for a retest of the $5K level.

Technical indicators show neutral readings, reflecting the stalemate between buyers and sellers. A sustained move above $4.6K could reignite bullish momentum, while failure to hold $4.2K support may trigger a retreat toward $3.8K.

The 4-hour chart reveals tentative signs of renewed buying interest, with ETH testing the $4.4K resistance. Market structure remains contingent on whether the asset can reclaim its ascending channel's midline.

Is ETH a good investment?

Based on current technical indicators and market developments, ETH presents a compelling investment opportunity. The cryptocurrency is trading above its key moving average with strong momentum indicators, while fundamental factors including institutional adoption and network growth support long-term value appreciation.

| Metric | Current Value | Signal |

|---|---|---|

| Current Price | $4,452.65 | Bullish |

| 20-Day MA | $4,402.68 | Support Level |

| MACD | 25.69 | Positive Momentum |

| Bollinger Upper | $4,646.06 | Resistance Level |

BTCC financial analyst Mia emphasizes that while short-term resistance around $4,646 may cause consolidation, the underlying fundamentals including institutional demand and staking activity growth position ETH favorably for potential movement toward the $5,000 level.